Ontario law requires all drivers on the road to be covered by a valid motor vehicle insurance policy. However, if you are involved in an accident and you or the party at-fault is uninsured, you are still eligible for insurance benefits. Whether it’s a hit-and-run or one party was driving drunk or driving without a license, accident benefits may be available. The process can be long and complicated (and sometimes confusing if you’re not fluent in legal jargon), but having a personal injury lawyer by your side can help you get the compensation you deserve.

What is the Motor Vehicle Accident Claims Fund?

When the responsible insurance company is unknown or nonexistent, the Motor Vehicle Accident Claims Fund (MVACF) steps in.. Benefits may include income replacement, medical care costs, and rehabilitation needs like at-home attendants or physical therapy.

Certain requirements must be met before the fund will grant payment, however. Governed by the Financial Services Commission of Ontario, the functions of the MVACF are:

- “To provide statutory accident benefits directly to persons involved in an automobile accident who have no recourse to automobile insurance.”

- “To provide compensation for personal injury or property damage to victims involved in an automobile accident with an uninsured or unidentified driver or a stolen vehicle when no liability insurance exists.”

- “To recover from the owners and drivers of uninsured vehicles monies paid out on their behalf, where legally permissible.”

(From the FSCO website)

The fund is a last resort means of claiming compensation after all other avenues have been exhausted, and the commission is clear about the process by which claimants can be compensated. It will only consider payment of claims under the Statutory Accident Benefits Schedule (SABS) if there is no recourse to auto insurance. MVACF is last on the priority list, specified under Section 268 (2) of the Insurance Act:

The priority for payment is as follows:

- “Recovery from your own automobile insurer (you are a named insured).”

- “Recovery from the insurer of the automobile in which you were an occupant.”

- “Recovery from the insurer of any automobile involved in the accident.”

- “If no other recovery is possible, MVACF may consider payment as mandated by Section 6 of the Motor Vehicle Accident Claims Act.”

What Does the Claimant Need to Do?

Determining if the MVACF is your last recourse is relatively straightforward, but bringing a tort claim against an uninsured or unidentified at-fault driver can be a complicated process. The Minister is only required to pay out of the MVACF for judgments in the claimant’s favour if the criteria established in the Motor Vehicle Accident Claims Act have been met. That burden rests with the claimant and his or her lawyer must help satisfy it.

Before making a tort claim under the MVACF, you must make every effort to identify the at-fault driver. Once identified, the next step is to establish that the other party is uninsured and that no other possible coverage is available. If the party at fault is protected under a family member’s insurance policy via the Family Protection Endorsement, you would not be eligible to receive assistance from the MVACF. This Endorsement was set up to protect family members of named policyholders in the event of injury or death as a result of wrongdoing by an under- or uninsured motorist.

Finally, the accident victim and his or her lawyer initiate an action and obtain a judgment; only then will the MVACF consider payment. Once this has been obtained, the claimant must also provide:

- “The original (or certified copy) of the judgment. (For Small Claims Court, an Affidavit for Enforcement Request is required.)”

- “A copy of the Statement of Claim.”

- “A copy of the assessed Solicitor and Client Account (in accordance with section 27 of the Act).”

What Are a Victim’s Rights?

Victims can sue for general and specific damages as well as Family Law Act claims and are required to pay a statutory deductible. The limit for third-party liability under the MVACF is $200,000 per occurrence (which includes pre-judgment interest), plus partial indemnity legal costs and disbursements. The sum is reduced by amounts payable for property damage claims if they exist.

MVACF isn’t required to pay a judgment unless it was first given notice of the uninsured motorist’s failure to defend the court action. In this case, a Notice of Default form must be submitted if the defendant (or defendants) have defaulted on the court action.

Property Damage Claims

You can also make a claim for compensation from the MVACF if you sustained property damage during a motor vehicle accident (i.e. if your wheelchair or bicycle was destroyed). Damage to an actual motor vehicle is not permitted under this program, however. The claims process for property damage is slightly different than it is for personal injury:

You must complete an application and submit the following to the MVACF:

- “Police Officer Report”

- “Damage estimates and/or repair invoice”

- “Notice of Collection of Personal Information form. (These forms need to be signed and returned only if the application is being made on behalf of a private individual and not a business or entity.)”

- “If an insurance policy is referenced on the police report, a letter from the insurer is required that outlines when the insurance policy was cancelled (date and time) and the reason for cancellation.”

Help is Available

Obtaining compensation can be a lengthy process, but there is recourse for your pain and suffering. The MVACF is available to all Ontarians if an accident occurred within the province and you or another driver does not have motor vehicle insurance. Hire a personal injury lawyer who will help you during this stressful time.

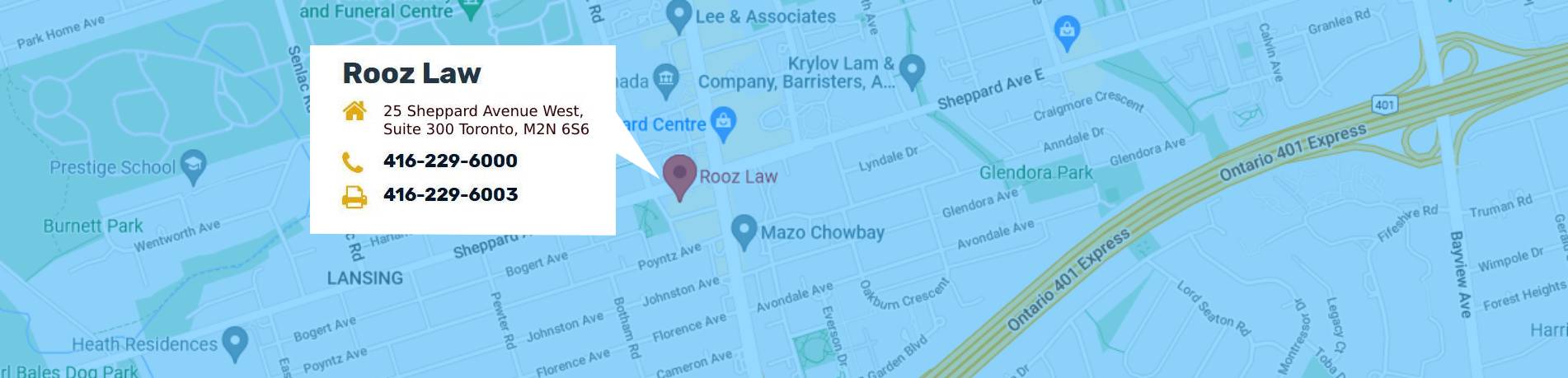

If you have been in a motor vehicle accident involving an uninsured or unidentified driver, call Rooz Law at (416) 229-6000. Our dedicated team of personal injury lawyers in North York and Toronto will fight for the compensation you deserve.