Many people are unfamiliar with the insurance set-up in the province of Ontario. One of the most significant sources of confusion is “which insurance provider must respond to claims after car accidents?” The simple answer here is that Ontario’s no-fault insurance system dictates that parties involved in accidents only have to deal with their insurance providers for claims, but not everyone has an insurer provider. Hence, the system is much more complicated than that. Read on for a more in-depth look at how Ontario’s insurance system works.

Ontario’s No-Fault Insurance System

Ontario is one of the Canadian provinces that have a no-fault insurance system in place. There is much confusion surrounding the concept of “no-fault insurance” because the term suggests that in accidents, fault is not assigned to any of the parties. However, this is far from how the system works.

Before the no-fault insurance system was put in place, the respective insurance providers of the parties involved first determine who is the party at fault. Once a decision has been made, the provider of the responsible party will pay out the claims of the injured parties. However, this process was arguably lengthy and costly. It also prevented many claimants from getting prompt medical and rehabilitation help.

In 1989, the no-fault insurance system was finally getting introduced in the province. In this system, your insurance provider answers to your claims, no matter who is the party determined to be at fault for the accident. As you no longer have to wait for the insurance companies involved to decide who the party to be held responsible is, filing your claims and receiving the compensation you are entitled has become a simpler and quicker process, at least in principle.

However, note that a degree of fault will still be assigned to each driver who was involved in the accident. The insurance providers of the parties involved use the Fault Determination Rules set by Ontario’s Insurance Act to assign a percentage (ranging from zero to 100) of fault to each driver. This means that drivers can be wholly or partially at fault in an accident, or have no fault at all.

What the Standard Insurance Package Covers

There are four insurance coverages that the government of Ontario deems as mandatory in a standard insurance package:

- Statutory accident benefits coverage – This mandatory coverage is what covers the benefits you are entitled to receive when you are injured in a motor vehicle accident, regardless of who is determined to be the driver responsible. This coverage includes rehabilitative and medical care, income replacement and non-earner benefits, and some optional benefits, if the coverage was purchased, such as caregiver or housekeeping expenses.

- Third party liability coverage – If you are sued because of the death or injuries that someone else sustained or because of damages to their properties due to your negligence, this is the insurance coverage that protects you. It pays for the claims that result from the lawsuit against you and the cost of settling these claims. There are minimum amounts of liability coverages, but you can opt to increase this value. Note that while this protects you during lawsuits, this coverage will not stop your premium from rising if you were found to be at fault in an accident.

- Uninsured automobile coverage – If you are involved in a hit-or-run accident, and there is no way of identifying the runner, you may benefit from the uninsured automobile coverage. This also protects you in instances where the other party is uninsured or underinsured.

- Direct compensation — property damage coverage – If you are not the party at fault for an accident, then this coverage provides you with benefits to cover damages to your car and its contents and the loss of the use of your vehicle or its contents. This is called direct compensation because if someone else was at fault for the damages, you file your claim directly with your provider. Your insurer then turns to the at fault party’s insurance for compensation.

In certain situations, you may sue the at-fault driver for compensation for the damages to your vehicle or claim your benefits under other applicable coverages that you have opted into, if any.

The above coverages are mandatory in Ontario and are included in the standard insurance package. Unless you purchased additional coverages, the province’s standard no-fault insurance system will not cover you in the following:

- Medical expenses that exceed your coverage – If your costs exceed the amount of your coverage, you may sue the other driver for compensation for the treatments you require for severe and permanent injuries that you sustained. However, this is only applicable if the accident occurred because of their negligence.

- Damage to your vehicle – You may purchase collision coverage to help you pay for repairs if your car was damaged in a collision with another and their insurer is not required to pay your insurer.

- Damage to another’s property – A property damage liability coverage can help you pay for damages that you may have caused on another person’s property.

If you have decided not to purchase additional coverages, you might have to pay for certain damages and expenses yourself.

Claims Against An At-Fault Driver

If you had to seek medical help immediately after the accident, collect all the receipts for money you spent out-of-pocket. As soon as you can, contact your insurance provider to begin the accident benefits claim process.

Although everyone who is involved in a car accident may claim compensation from their insurance providers regardless of fault, you may be entitled to additional compensation if you sustained injuries due to the negligence of another person by suing them for:

- Pain and suffering

- Medical and rehabilitation treatment

- Housekeeping services

- Loss of current or future income

- Caregiving services

On the other hand, family members of the seriously injured party (or someone who lost their lives in an accident) may sue the at-fault driver for compensation for:

- Loss of companionship

- Loss of care

- Loss of guidance

Family members may also sue for the economic value of services provided to their insured famliy member as well.

Uninsured Drivers And Vehicles

If you are involved in a car accident where none of the parties are covered by automobile insurance, you may still claim benefits for the injuries you sustained or compensation for the damages to your vehicle. You are eligible for compensation from the Motor Vehicle Accident Claims Fund if you You were involved in a collision within Ontario, and none of the parties had an applicable insurance coverage

Although the government has the funds in place to financially help uninsured motorists if they are involved in an accident, being an uninsured driver in Ontario has legal consequences. Failing to provide proof of insurance in Ontario can result in a fine of $5,000 (exclusive of tax) and repeat offender may have to spend some time in jail.

In conclusion, Ontario’s no-fault insurance system makes the claim process much quicker because you only have to deal with your provider for compensation of certain benefits but by no means is the process simple or easy.In instances where your coverage is not enough, or if you qualify for pain and suffering compensation, you may have to sue the driver at fault for more compensation.If all parties in the accident are uninsured, the Motor Vehicle Accident Claims Fund may be of assistance.

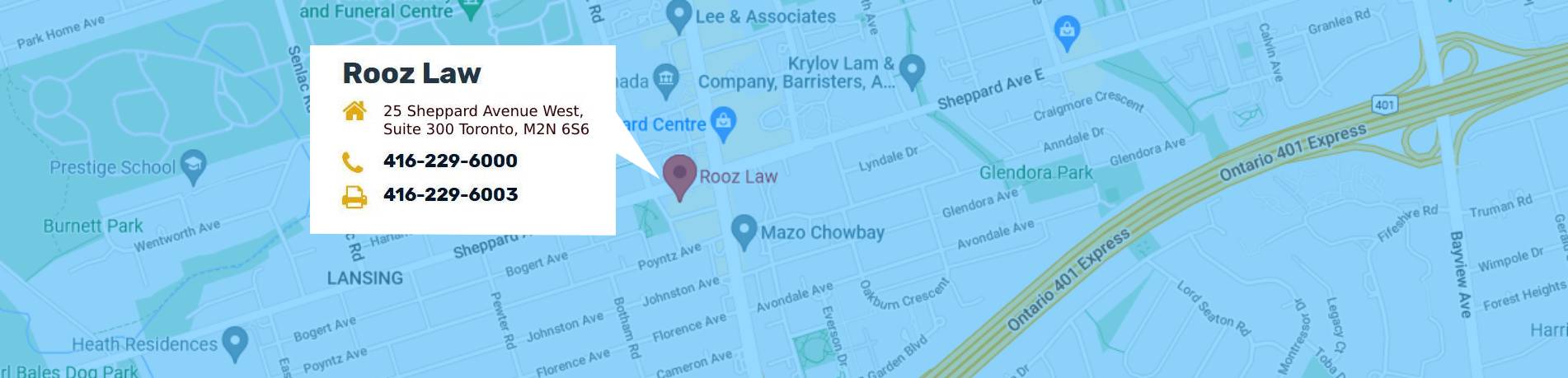

If you have sustained serious and permanent injuries due to the negligence of another, you may need a personal injury lawyer. Rooz Law Personal Injury Lawyers in North York specializes in cases involving accident benefits, motor vehicle accidents, personal injury, and the like. To make an appointment with us, call (416) 229-6000.